Covid taught us a lot of things, not the least of which is that humans need to stay connected, pandemic or no pandemic. Seemingly overnight, we switched from in-person meetings to Zoom calls. I even saw people partaking in virtual happy hours. Does that make the Zoom call organizer the designated driver?

The need for advisors to stay connected to clients is nothing new. Studies have shown that, in order to stay relevant and ensure that we don’t lose clients, advisors should have 12 to 18 meaningful client touchpoints a year.

A client of mine once told me why she left her previous advisor: “He would call me up, once a month, to ask me how I was doing,” she said. “We rarely talked about my finances or how he could help improve my situation. He just wanted to shoot the breeze. I don’t have time for that. Not to mention the fact that it was very awkward.”

Effective client touchpoints have two important qualities:

1) They have content that is relevant and

2) They have a method that is neither intrusive nor burdensome.

Relevant content means not only relevant to financial planning, but also relevant to the individual client and his/her needs. There is no point engaging a client who doesn’t have kids on the subject of college planning. Nor does it make sense to engage a retired couple on the topic of HR benefits planning. Each engagement experience needs to be thoughtful and not one-size-fits-all.

Using a method that is not intrusive or burdensome means making it as painless as possible for the client to engage with you. None of the following traditional means of engagement fit that bill particularly well:

- In-Person – Very time-consuming and inconvenient.

- Virtual – More convenient than in-person, but requires scheduling, time and, yes, grooming oneself.

- Email – Not very engaging, since it is not a structured/guided experience. Many emails go unanswered because they feel like the recipient is part of a large-scale email campaign.

- Telephone – Very intrusive, especially if not scheduled (even scheduling requires additional steps).

- Snail Mail – Well, this one is just weird nowadays. I can’t remember the last time I received a hard copy letter that wasn’t from some government agency.

This is not to say that the above methods of engagement should never be used. Each method has its time and place. But to get to 12 to 18 touchpoints in a year, you need a system that is convenient, effective, and easy for you and your client. And that system, my friend, is PreciseFP.

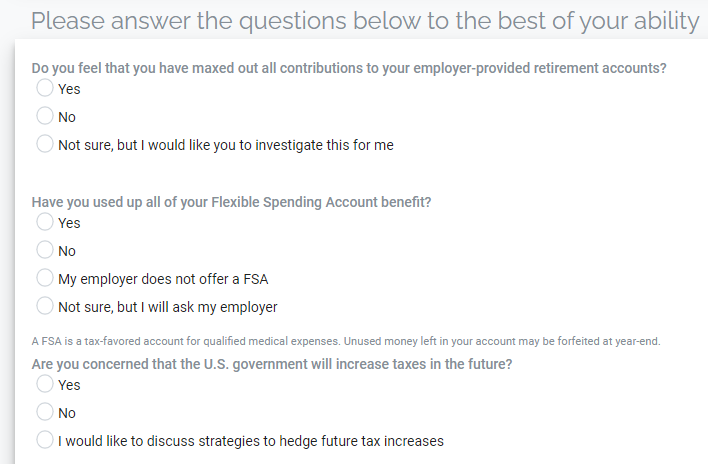

With PreciseFP, I can send out an end of year tax planning engagement where clients can answer a few short questions in minutes. A quick analysis of the answers allows me to easily find opportunities to help improve my client’s situation.

How easy is that? The client perceives it as you caring enough to ask the questions and consider his/her situation. It takes you seconds to send an engagement like this out via PreciseFP and no more than a few minutes for your client to respond. Other examples of what I call “continuous engagement” topics may include:

- Vacation Budget Planning

- Financial Goals Update

- Risk Tolerance Review

- Estate Planning Update

- Student Debt Planning

- Satisfaction Survey

PreciseFP gives you the most powerful form builder in the industry and the platform to engage clients the way clients want to be engaged. You are limited only by your imagination.

I challenge you to build out 6 continuous engagement forms in PreciseFP and start using them today. If you add them to your client meetings and other mailings that you already do, you’ll likely be at or above the 12 yearly touchpoints that we should all have as our goal. Our content library makes it easy to get started with ready-made form templates that you can use as-is or customize them to fit your firm’s needs.

Don Whalen, CFP®, President